A profit and loss presentation template is a valuable tool for businesses of all sizes. It provides a clear and concise overview of a company’s financial performance over a specific period, typically a quarter or a year. This information can be used to track progress, identify trends, and make informed decisions about the future.

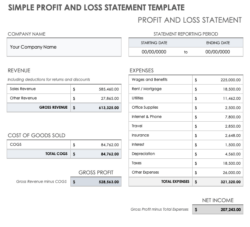

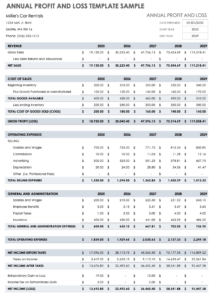

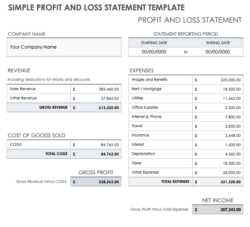

Profit and loss presentation templates come in many different formats, but they all share some common elements. These elements typically include revenue, expenses, profit or loss, and net income. Some templates may also include additional information, such as gross profit, operating profit, and EBITDA. The best profit and loss presentation template for a particular business will depend on its specific needs.

What to Include in a Profit and Loss Presentation Template

The following is a list of items that are typically included in a profit and loss presentation template:

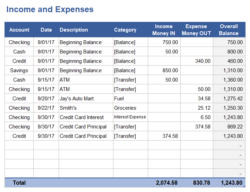

- Revenue: This is the total amount of money that a company has earned from its sales or services.

- Expenses: These are the costs that a company has incurred in order to generate revenue. Expenses can be divided into two categories: operating expenses and non-operating expenses. Operating expenses are those that are directly related to the company’s core business, such as salaries, rent, and marketing. Non-operating expenses are those that are not directly related to the company’s core business, such as interest payments and gains or losses on investments.

- Profit or loss: This is the difference between revenue and expenses. A profit occurs when revenue exceeds expenses, while a loss occurs when expenses exceed revenue.

- Net income: This is the profit or loss after all taxes have been paid. Net income is the bottom line of a profit and loss statement and represents the amount of money that a company has earned after all of its expenses have been paid.

In addition to the items listed above, profit and loss presentation templates may also include the following:

- Gross profit: This is the profit that a company has earned from its sales or services before deducting operating expenses.

- Operating profit: This is the profit that a company has earned from its sales or services after deducting operating expenses but before deducting non-operating expenses.

- EBITDA: This is a measure of a company’s profitability that is calculated by adding back depreciation and amortization to net income.

How to Use a Profit and Loss Presentation Template

Profit and loss presentation templates can be used in a variety of ways. They can be used to:

- Track progress: Profit and loss presentation templates can be used to track a company’s financial performance over time. This information can be used to identify trends and make informed decisions about the future.

- Identify opportunities: Profit and loss presentation templates can be used to identify areas where a company can improve its profitability. For example, a company may be able to increase its revenue by increasing sales or by offering new products or services. A company may also be able to reduce its expenses by negotiating better deals with suppliers or by reducing waste.

- Make informed decisions: Profit and loss presentation templates can be used to make informed decisions about the future of a company. For example, a company may decide to invest in new equipment or to expand into new markets. Profit and loss presentation templates can also be used to make decisions about pricing, marketing, and other business strategies.

Profit and loss presentation templates are a valuable tool for businesses of all sizes. They can provide a clear and concise overview of a company’s financial performance and can be used to track progress, identify opportunities, and make informed decisions about the future.